Buckle up, car enthusiasts! The UK car tax landscape is about to undergo a dramatic transformation, and it’s crucial to be in the driver’s seat when it comes to understanding these changes. Whether you’re a seasoned petrolhead, an EV advocate, or simply looking for your next set of wheels, these VED (Vehicle Excise Duty) revisions will undoubtedly impact your wallet. So, let’s dive in and explore everything you need to know about the car tax changes hitting UK roads.

The Electric Shock: VED for EVs

Perhaps the most significant change? Electric vehicles (EVs), once enjoying the open road of tax exemption, are now entering the realm of VED. Yes, you read that right. While previously exempt, all EV owners will soon be contributing to the Treasury. But what exactly does this mean for you? Starting April 1st, new EV owners will pay a nominal £10 for the first year, followed by the standard £195 annually. For those who already own an EV registered between April 2017 and March 2025, the £195 standard rate kicks in immediately.

Is this a fair move? The then-Chancellor, Jeremy Hunt, argued it creates a “fairer motoring tax system” considering the growing popularity of EVs. But, this shift undeniably raises questions about affordability and potentially impacting the adoption of greener vehicles.

The Luxury Levy: Expensive Car Supplement

Adding another layer of complexity, the “expensive car supplement,” also known as the “luxury car tax,” remains in effect. This supplement applies to vehicles with a list price exceeding £40,000, regardless of their fuel type. What’s the catch? Owners of these vehicles will pay an additional £425 annually for five years (from the second to the sixth year of ownership) on top of the standard rate. Considering many EVs fall into this price bracket, this supplement could arguably discourage potential buyers.

Petrol & Diesel: Double Trouble

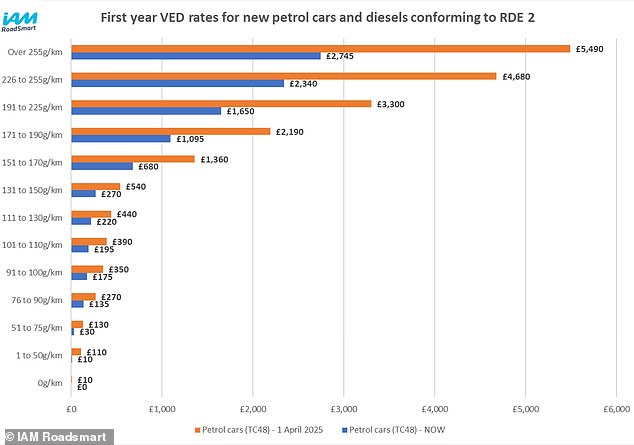

Owners of petrol and diesel vehicles aren’t off the hook either. Prepare for a hefty increase, especially if your vehicle is a high emitter. The first-year VED for these vehicles will double, impacting new car buyers the hardest. This “shove rather than a nudge” towards EV adoption, as some experts call it, raises concerns about affordability for families and individuals relying on traditional fuel types.

Hybrids: No More Free Ride

Previously, hybrid vehicles enjoyed a small discount on their first-year VED. Those days are gone. Now, hybrids will be subject to the same VED rates as their petrol and diesel counterparts. This might leave some hybrid owners feeling a bit cheated, especially those who chose a hybrid for its perceived financial benefits.

Navigating the Changes: Expert Tips

- Explore all your options: Don’t limit yourself to one brand or type of car. Explore different models and brands, including those you might not typically consider, to find the best deal. You might be surprised at the competitive pricing available.

- Look for discounts: Check with your employer or professional organizations for potential discounts on new car purchases. Many industries offer special deals that can significantly reduce the overall cost.

- Factor in long-term costs: When comparing vehicles, consider not only the purchase price but also the long-term costs, including VED, insurance, and fuel or electricity. A slightly more expensive car might be cheaper in the long run due to lower running costs.

- Consider used EVs: While the luxury car tax might make new EVs less appealing, used EVs offer a way to enjoy the benefits of electric driving without the added tax burden.

- Stay informed: Keep up-to-date on the latest VED rates and regulations. Use online resources like the DVLA website or comparison sites to calculate your potential car tax liability.

What Does this Mean for the Automotive Landscape?

These car tax changes are poised to reshape the UK automotive market. Will they accelerate the transition to electric vehicles, or will they create barriers for potential EV buyers? The long-term impact remains to be seen. One thing is certain: staying informed and adapting to these changes is key for any car owner or prospective buyer.

A Final Thought…

These car tax changes are complex, to say the least. They represent a significant shift in how we think about car ownership in the UK. While aimed at promoting greener vehicles and creating a fairer tax system, their impact on individual drivers remains a subject of ongoing debate. Are these changes the right move for the UK’s automotive future? Let’s keep the conversation going. What are your thoughts?

Top Electric Vehicle Reviews: Navigating the New VED Landscape

With the new VED changes impacting electric vehicle owners, it’s more crucial than ever to choose the right EV for your needs and budget. Here are a few top-rated EVs that deserve a spot on your shortlist:

Tesla Model 3: The Benchmark

The Tesla Model 3 continues to set the standard for electric cars. Its sleek design, impressive range, and cutting-edge technology make it a popular choice. However, with its price tag pushing it into the luxury car supplement bracket, consider the long-term costs.

Nissan Leaf: The Affordable Option

The Nissan Leaf offers a more budget-friendly entry point into the world of EVs. While its range might not be as impressive as the Model 3, it’s a practical and reliable option for city driving and shorter commutes.

Polestar 2: The Stylish Contender

The Polestar 2 combines Scandinavian design with impressive performance. Its premium interior and advanced features make it a strong competitor in the EV market.

Maintaining Your Petrol or Diesel Engine in the Face of Rising VED

With VED increases for petrol and diesel vehicles, maximizing fuel efficiency and minimizing maintenance costs is paramount. Here are some expert tips to keep your engine running smoothly:

Regular Servicing is Key

Sticking to your car’s recommended service schedule is essential for preventing costly repairs down the line. Regular oil changes, filter replacements, and inspections can significantly extend the life of your engine.

Tyre Pressure Matters

Maintaining the correct tyre pressure not only improves fuel efficiency but also enhances handling and safety. Check your tyre pressure regularly and adjust as needed.

Drive Smart, Save Fuel

Adopting fuel-efficient driving habits, such as avoiding harsh acceleration and braking, can significantly reduce your fuel consumption and save you money at the pump.

The Future of Automotive: Emerging Trends to Watch

The automotive industry is in a constant state of evolution. Here are a few emerging trends that are shaping the future of driving:

Self-Driving Cars: A Reality Check

Autonomous vehicles are no longer a futuristic fantasy. While fully self-driving cars are still some way off, advanced driver-assistance systems (ADAS) are becoming increasingly common, paving the way for a driverless future.

Connected Cars: The Internet of Things on Wheels

Cars are becoming increasingly connected, with features like in-car Wi-Fi, real-time traffic updates, and remote diagnostics. This connectivity enhances the driving experience and offers new levels of convenience.

Sustainable Mobility: Beyond Electric

While EVs are leading the charge towards sustainable mobility, other alternative fuel technologies, such as hydrogen fuel cells and biofuels, are also gaining traction.

Have Your Say! Join the Conversation

What are your thoughts on the new car tax changes? Share your opinions and experiences in the comments section below. Let’s discuss the future of driving together!

Frequently Asked Questions about the UK Car Tax Changes

Do electric vehicles have to pay car tax now?

Yes, as of April 1st, new electric vehicles (EVs) are subject to VED. New EV owners will pay £10 for the first year, followed by the standard £195 annually. EVs registered between April 2017 and March 2025 will pay the standard £195 rate immediately.

What is the expensive car supplement?

The expensive car supplement, also known as the luxury car tax, is an additional annual tax of £425 for five years (from years 2-6 of ownership) applied to vehicles with a list price exceeding £40,000, regardless of fuel type.

How are petrol and diesel car tax rates changing?

The first-year VED for petrol and diesel vehicles is doubling, with higher rates for high-emission vehicles. Subsequent years will also see increased rates.

< h4>Do hybrids still get a car tax discount?

No, the previous discount on first-year VED for hybrid vehicles has been eliminated. Hybrids are now taxed at the same rate as comparable petrol and diesel vehicles.

The Road Ahead for UK Car Tax

These VED changes mark a significant shift in UK car taxation. While designed to encourage electric vehicle adoption and create a fairer tax system, their long-term effects are yet to be determined. The increased costs for petrol, diesel, and even electric vehicles could create affordability challenges for many motorists. Staying informed and adapting to these evolving regulations will be crucial for all UK car owners and prospective buyers.